The financial world is constantly evolving, with new entities emerging due to corporate restructuring, mergers, or rebranding. 20230930-DK-Butterfly-1 has recently gained attention, leaving many investors and market analysts questioning its origin, purpose, and financial impact.

In this article, we will explore:

✅ What is 20230930-DK-Butterfly-1?

✅ The role of DK-Butterfly bonds

✅ Investment considerations and risks

✅ How it compares to traditional financial instruments

Let’s dive into everything you need to know about 20230930-DK-Butterfly-1.

What is 20230930-DK-Butterfly-1?

Origin and Background

20230930-DK-Butterfly-1 appears to be a financial entity or structured product associated with the DK-Butterfly bond market. The name suggests a classification based on bond structuring, financial instruments, or a corporate transition from a previously recognized company.

What is the DK-Butterfly Strategy?

The DK-Butterfly strategy refers to a structured financial model used in bond trading and interest rate strategies. It typically involves:

- A balanced investment strategy combining long-term and short-term bonds

- Risk mitigation by diversifying maturity dates

- Interest rate sensitivity to maximize bond yield returns

Understanding whether 20230930-DK-Butterfly-1 is linked to bond investment models is crucial for potential investors.

Read Also: Nasdaq:DJT – Trump Media & Technology Group Stock

The Role of DK-Butterfly Bonds

What Are DK-Butterfly Bonds?

DK-Butterfly bonds are structured fixed-income securities used for:

📌 Interest rate hedging – Minimizing exposure to market fluctuations

📌 Portfolio diversification – Spreading risk across different maturities

📌 Stable returns – Generating income from fixed interest payments

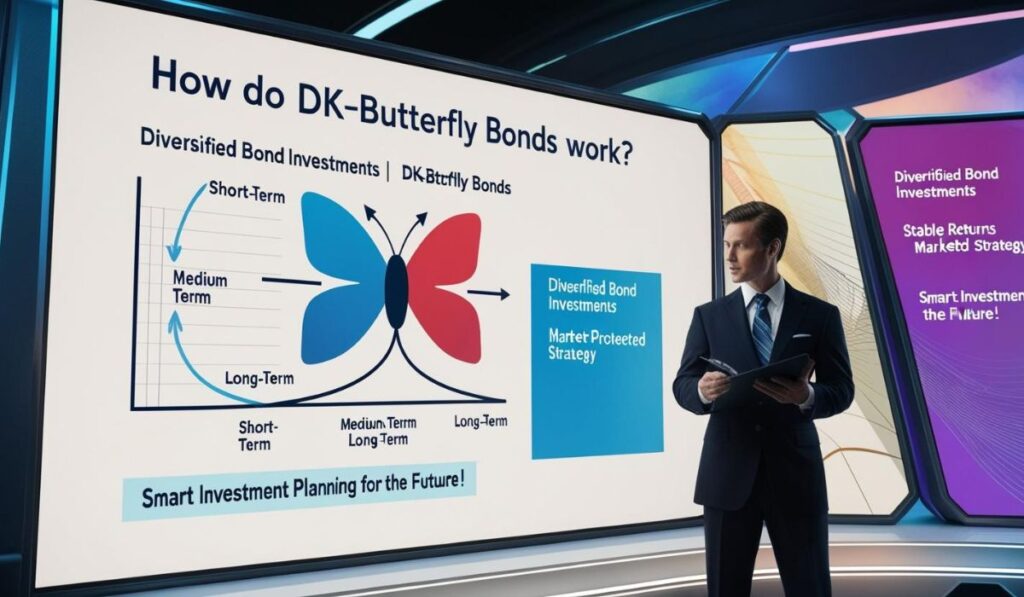

How Do DK-Butterfly Bonds Work?

| Bond Type | Maturity Duration | Risk Level | Investment Use |

|---|---|---|---|

| Short-Term Bonds | 1-3 Years | Low | Liquidity & Stability |

| Medium-Term Bonds | 4-10 Years | Moderate | Balanced Portfolio |

| Long-Term Bonds | 10+ Years | High | High Yield & Growth |

The butterfly bond approach balances these three bond categories, creating an investment strategy that maximizes returns while minimizing risks.

Read Also: PlugboxLinux Contact: How to Get Support and Assistance

Investment Considerations and Risks

Benefits of Investing in DK-Butterfly Bonds

✅ Diversified Investment – Spreads risk across different bond categories

✅ Predictable Returns – Fixed-income structure ensures stable earnings

✅ Lower Volatility – Compared to stocks, bond investments are less affected by market fluctuations

Potential Risks to Consider

⚠️ Market Sensitivity – Interest rate fluctuations can impact bond value

⚠️ Liquidity Issues – Some structured bond products may have low liquidity

⚠️ Economic Downturns – During financial crises, bonds may not perform as expected

Investors should evaluate their risk tolerance before entering DK-Butterfly bond markets.

How DK-Butterfly Bonds Compare to Traditional Bonds

DK-Butterfly Bonds vs. Traditional Bonds

| Feature | DK-Butterfly Bonds | Traditional Bonds |

|---|---|---|

| Structure | Combination of short, medium, and long-term bonds | Fixed duration with no diversification |

| Risk Level | Lower due to diversification | Varies based on bond type |

| Investment Focus | Hedging against interest rate changes | Long-term fixed-income strategy |

| Liquidity | May be lower in certain markets | Generally more liquid |

The diversified approach of DK-Butterfly bonds provides a stable alternative to standard bonds, making them attractive to institutional investors and long-term financial planners.

Read Also: LotteryGameDevelopers.com: The Lottery Gaming Industry

FAQs

1. What is 20230930-DK-Butterfly-1?

📌 20230930-DK-Butterfly-1 is likely a structured financial entity or bond investment model, associated with the DK-Butterfly strategy.

2. How do DK-Butterfly bonds work?

📌 DK-Butterfly bonds combine short-term, medium-term, and long-term bonds to create a stable, diversified investment strategy.

3. Are DK-Butterfly bonds a good investment?

📌 They offer predictable returns and lower risk than stocks, making them suitable for investors seeking stable income.

4. What are the risks of DK-Butterfly bonds?

📌 Market volatility, interest rate changes, and liquidity issues can impact bond value.

5. How can I invest in DK-Butterfly bonds?

📌 Consult a financial advisor or explore institutional bond investment platforms to learn more.

Final Thoughts on 20230930-DK-Butterfly-1

📢 20230930-DK-Butterfly-1 represents an investment structure that focuses on stability, diversified bond strategies, and long-term financial security. Whether you’re a bond investor, financial analyst, or institutional planner, understanding the DK-Butterfly bond market is crucial to making informed investment decisions.

💡 Always research and consult financial experts before making bond investments! 🚀